About FCi2

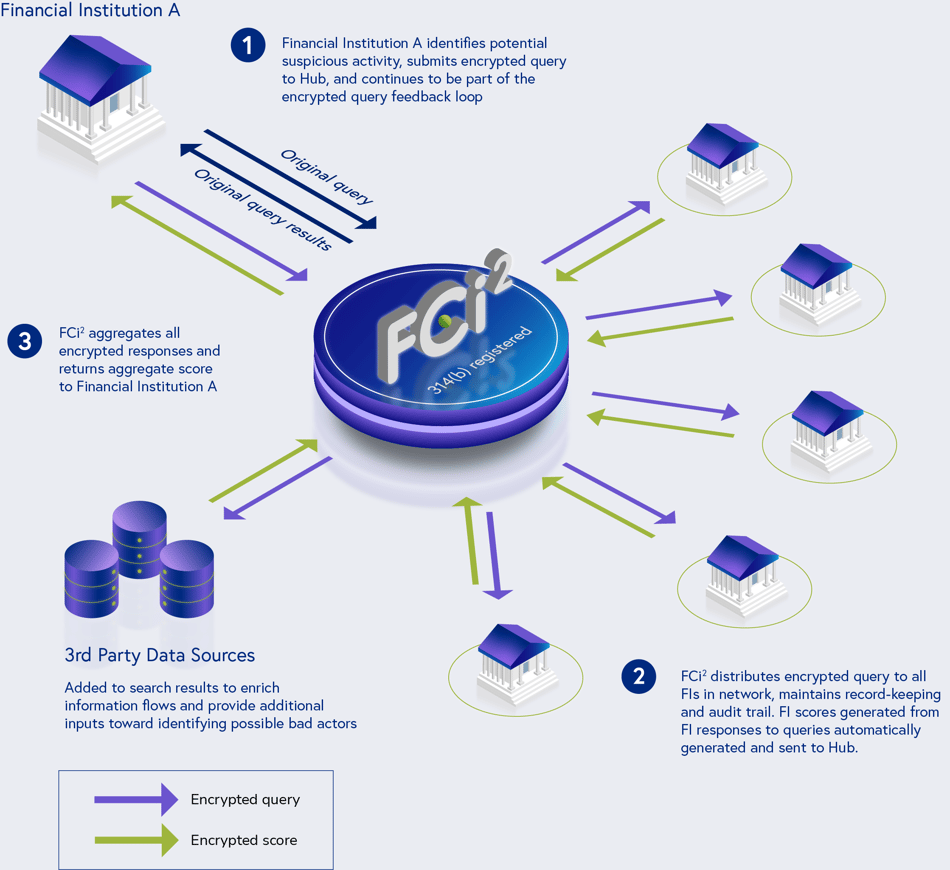

Financial Crime Intelligence & Insights, (FCi2) serves as a secure automated information sharing hub for participating financial institutions. FCi2 uses advanced technology to its fullest, providing banks a more complete view of potential AML/CFT, fraud, sanctions and cyber-crime activities.

Developed in consultation with law enforcement. FCi2 transforms the fight against financial crime, taking it from reactive to proactive, exposing illegal activity at a much earlier stage of development. FCi2 uses multiple sources of information from a wide variety of business sectors to generate more informed and almost immediate investigative results.

About FCi2

Financial Crimes Intelligence & Insights (FCi2) serves as a secure, automated information sharing hub for participating financial institutions. FCi2 harnesses advanced technology to offer banks a more complete view of potential AML/CFT, fraud, and cybercrime activities.

Developed in consultation with law enforcement, FCi2 transforms the fight against financial crime. By using a proactive approach rather than the traditional reactive methodologies, FCi2 will expose illegal activity at a much earlier stage. It uses multiple sources of information from a wide variety of business sectors to generate more informed investigative results far quicker than previously possible.

Proactive

Meets Confidentiality Requirements/Data encrypted

Federated search function

No data exported to centralized database

Almost Immediate responses

Automated searches

Possible joint (automated) SARs/STR filings

314(a) possibilities

Benefits to Financial Institutions

Better and faster 314(b) and fraud related information

More complete AML, sanctions and fraud investigative information

Reduced 314(b) filings

Reduced false positives

Higher customer retention

Auto close more cases

Expanded cyber threat intelligence

Flexibility to immediately respond to changing typologies

Better risk management

Regulators across the globe are seeking technology solutions to enable banks to improve information sharing and limit financial crime. Homomorphic encryption enables data sharing without violating privacy considerations. Encrypted analysis is conducted on data in its original environment, eliminating the need to export data into a common centralized database. In the United States, FCi2 facilitates information sharing under 314(b) of the PATRIOT Act.

Benefits to Financial Institutions

Material cost savings and opportunities for resource reallocation

Better and faster 314(b) and fraud-related information

More complete investigative information for AML and fraud

Reduced 314(b) filings

Reduced false positives

Higher customer retention

Ability to auto close more cases

Expanded cyber threat intelligence

Flexibility to respond to changing typologies immediately

More effective risk management

Regulators worldwide are seeking technology solutions that enable banks to improve information sharing and limit financial crime. Revolutionary homomorphic encryption enables data sharing while protecting privacy and provides greater transparency across the financial system. Encrypted analysis of data is now possible in its original environment, eliminating the need to export data into a common centralized database. In the United States, FCi2 facilitates information sharing under 314(b) of the PATRIOT Act.

Financial Institution (FI) comprised utility developed in partnership with law enforcement, using technology to the fullest, to proactively address sanctions, combat AML, fraud, and cyber-crimes.

How It Works

Transformative Advantages of FCi2

- Proactive

- Meets Confidentiality Requirements/Data encrypted

- Federated search function

- No data exported to centralized database

- Almost Immediate responses

- Automated searches

- Possible joint (automated) SARs/STR filings

- 314(a) possibilities

Transformative Advantages of FCi2

- Proactive

- Meets Confidentiality Requirements/Data encrypted

- Federated search function

- No data exported to centralized database

- Almost Immediate responses

- Automated searches

- Possible joint (automated) SARs/STR filings

- 314(a) possibilities

The Cost of Financial Fraud

$10.3 Billion

Victim losses in 2022

2,175+

Average complaints received daily

52% of companies with more than USD 10 billion in revenue have experienced a fraud in the past 24 months

52% of companies with more than USD 10 billion in revenue have experienced a fraud in the past 24 months

52% of companies with more than USD 10 billion in revenue have experienced a fraud in the past 24 months

Source: Federal Bureau of Investigation Internet Crime Report 2022

.png?width=800&height=687&name=MicrosoftTeams-image%20(21).png)

$10.3 Billion

Victim losses in 2022

651,800+

Average complaints

received per year

(last 5 years)

2,175+

Average complaints

received daily

Over

7.3 Million

Complaints reported

since inception

Source: Federal Bureau of Investigation Internet Crime Report 2022

$10.3 Billion

Victim losses in 2022

2,175+

Average complaints

received daily

651,800+

Average complaints

received per year

(last 5 years)

Over

7.3 Million

Complaints reported

since inception

Source: Federal Bureau of Investigation Internet Crime Report 2022